On the topic of financial planning, American economist Paul Samuelson once said, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.” Of course, some athletes have no problems going to Vegas, and they take a lot more than $800 with them. For example, golfer John Daly once claimed that he lost between $50 million and $60 million on bad bets.

If the rest of us had $50 million to lose, we’d probably invest in the stock market. In fact, a lot of athletes invest their millions in securities or in business ventures. Unfortunately, a bad bet on Wall Street is just as costly as a bad bet in Vegas. Here’s a look at some athletes who found out the hard way.

Curt Schilling

After retiring from the Boston Red Sox in 2009, former Major League Baseball pitcher Curt Schilling created a video game company called 38 Studios. He invested $50 million dollars into the company. “I made an insane amount of money playing baseball,” Schilling told ABC News. “I’ve always wanted to be the best in the world as a baseball player, so when I started to think about opening a business, it was with that mindset.”

Unfortunately, 38 Studios ended up filing for bankruptcy, leaving 300 employees unemployed and Schilling with empty pockets.

Schilling moved his company to Rhode Island from Massachusetts in 2010 because the Ocean State offered him $75 million in loan guarantees. Lincoln Chafee, who was running for governor of Rhode Island as an independent, spoke out against the loan guarantee and questioned the solvency of 38 Studios. Schilling told ABC News that Chafee’s comments made private investors unwilling to fund his company. “The money I had earned and saved in baseball was all gone,” Schilling said. “I’m not asking for sympathy. That was my choice.”

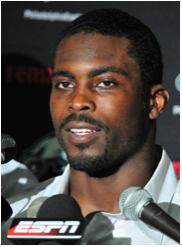

Michael Vick

Dog lovers aren’t the only people who love to hate Michael Vick. After spending 21 months in federal prison for operating a dog-fighting operation, Vick filed for Chapter 11 bankruptcy in 2008. In addition to running afoul with numerous creditors, his financial planning woes existed in the millions of dollars in loans to invest in several businesses, including a car-rental business in Indiana, and had failed to pay the loans back to the banks.

However, anyone who likes to bet on sports knows that when it comes to Michael Vick, they can always count on a comeback. Vick, who was named the NFL’s 2010 Comeback Player of the Year, is currently a quarterback for the New York Jets.

Lenny Dykstra

Former Oakland A’s general manager Billy Beane, the subject of the hit book and film “Moneyball,” told author Michael Lewis that Lenny Dykstra was perfectly emotionally designed to play baseball. “He was able to instantly forget any failure and draw strength from every success,” Beane said. “He had no concept of failure.”

Unfortunately, Dykstra’s fearlessness ended up landing him in prison for bankruptcy fraud. After retiring from baseball, he earned a reputation as a pretty good investment advisor; Jim Kramer even tapped Dykstra to write a column for The Street. Unfortunately, his financial planning exploits landed him in serious debt and forced him to sell his World Series ring. After being found guilty of lying under oath and improperly hiding assets during bankruptcy, Dykstra spent six-and-a-half months in prison.

Scottie Pippen

Scottie Pippen had formidable on-court prowess, but his financial prowess has left a lot to be desired. Pippen, who came from a financially disadvantaged background, accepted far less than he was worth from the Bulls in exchange for a long-term contract.

However, Pippen’s most famous miss came when he invested $3.25 million in a real estate development on Chicago’s South Side as well as $4 million for a share of a 25-year-old Gulfstream jet. In addition to the money he invested in the jet, Pippen eventually paid $6 million for repairs as well as principal, interest and legal fees regarding a $5 million loan on the jet that he didn’t know he’d acquired.

Pippen sued his financial advisor, Jeremy Lunn, and won $1.5 million. He also sued his attorneys for malpractice and was awarded another $2 million.

The Bottom Line on Financial Planning

Financial planning can be just as hazardous as gambling, even for pro athletes. Still, like most of life’s hazardous activities, there’s something to be said for the ride.

After retiring from the Boston Red Sox in 2009, former Major League Baseball pitcher Curt Schilling created a video game company called 38 Studios. He invested $50 million dollars into the company. “I made an insane amount of money playing baseball,” Schilling told ABC News. “I’ve always wanted to be the best in the world as a baseball player, so when I started to think about opening a business, it was with that mindset.”

Let’s talk about a great chance to make easy money on the Internet, because we live in a digital time. Visit the site https://nodepositz.com/manhattan-slots/ which hosts one of the best online casinos. Don’t waste this great chance for a better life.

It can happen every time you are involved in betting or online casino games, nevertheless, you win or lose. In short, it disturbs your natural flow of life as you are spending most of the time playing games or betting.

I was delighted to read your post. But I’d want to make a few broad observations. amazing content, amazing website design.